According to the infamous Shiller P/E matrix, the only sector worth investing in these days (at least in the US) is the energy sector. The Shiller P/E for the sector is currently 11.9x vs. 26.3 for the S&P 500 as a whole. What a significant discount or what?

There is only one problem with the

Shiller P/E, it will only work as a buy signal if the depressed earnings of

the energy companies make a comeback, and this will only happen if the oil

price moves back to previously seen levels within a reasonable time-frame.

Stating that energy stocks are cheap due to a low Shiller P/E is the same as

making the statement that the oil price will make a comeback.

Shiller P/E by sector:

Shiller P/E by sector:

Source: Gurufocus

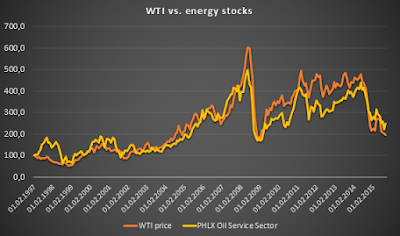

Oil prices and energy stocks track each other like no other, and you have to be a believer that oil demand will outstrip oil supply at some point during the near future in order to trust energy stocks as a value play. From the looks of it, oil stocks have not strayed away from their normal close tracking of the oil price during the current downturn.

Oil price vs. energy stocks:

Source: Gurufocus

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving any compensation for it.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving any compensation for it.