Currently it is quite simple to make the case for a lower oil price in the short-term and Goldman Sachs has stated that there is a high probability for the oil price to plunge to 20 USD/ bbl in the coming months.

The case for a lower oil price in the short-term:

- A mild upcoming winter has been predicted

- It costs more to store oil as cheap storage already has been filled

- Even stronger dollar due to expected higher interest rates in the US

- Increased supply from Iran

Currently oil is trading at a mid to long-term disequilibrium as the marginal cost of replacing the oil we are currently consuming is significantly greater than the current price (70 - 80 USD/ bbl.). Furthermore demand is growing.

Stein´s law simply states that "if something cannot go on forever, it will stop". As for the oil price we can restate the simple but brilliant quote to: "since the oil price cannot trade below its marginal replacement cost forever, it will stop". For you that don not know, Herbert Stein is the former Chief Economist to Richard Nixon.

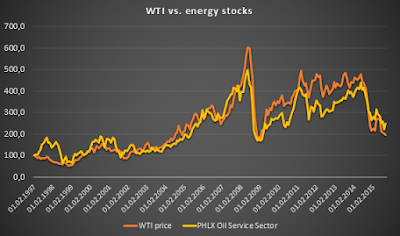

We do not know when the oil price will bounce back, however we know it will. My best guess is at some point during 2016 - 2018 (due to the case I made some weeks ago). As a long only value investor with a long-term horizon I am heavily invested in dirt cheap oil companies. At some point I am quite sure it will make me a lot of money... in the meantime the hedge fund shorts will laugh their shorts of making money hand over fist.

If the oil price plunges even lower in the short-term I will buy even more oil stocks.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving any compensation for it.