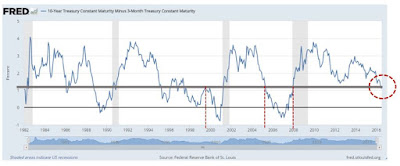

A former professor of mine who was more of a practitioner than an academic (Merrill Lynch guy) once told me that the only factor I had to focus on in order to detect a incoming crash was the slope of the yield curve. He told me that the flattening of the yield curve usually screams "there is a recession coming!". When the yield on a 10 year treasury note minus the yield on a 3 month treasury bill moves close to zero, it is time to sell everything. He also stated something along the lines of: "don't listen to the fucking talking heads telling you that it is different this time around".

As observed from the below chart I have drawn a thick line from today's point on the chart. I have also drawn tangents from past intersecting points. The 10Y yield minus the 3M yield was the same value as today in 2008, 2006 and 1999. You do the math. Sell everything.

I can't predict when the US market will crash, however, I know it is getting close. I am on the sidelines for this one (frankly, my intention is to profit from it).

Yield on 10Y treasury minus the yield on 3 month bill:

Source: Federal Reserve Bank of St. Louis and Oeistein Helle

The professor and me (who will stay anonymous for the most of you):

I was truly in need of a haircut back then.

Disclosure: I wrote this article myself, and it expresses my own opinions. I am not receiving any compensation for it.