This article was first published on SeekingAlpha August 1. 2016:

http://seekingalpha.com/article/3994109-george-soros-bubble-theory-current-state-markets

Summary

George Soros does not believe that markets are efficient. Instead, he believes that markets slide away from the fundamentals over time.

Mr. Soros has developed a five-step boom and bust theory.

The theory seems to fit the current S&P 500 boom cycle and the model fits previous boom and bust cycles quite well.

Before I start to discuss George Soros' bubble theory, I would like to give you a short summary of some of his accomplishments as an investor highly attuned to market cycles (the man himself does not need an introduction):

- In September of 1992, he made a USD 10 billion bet speculating that the British pound would depreciate. He was correct and reportedly profited USD 1 Billion in one day.

- He accurately predicted the 2008 crisis as the greatest financial crisis of his lifetime. I made a google search and found this article from early 2008 where he discusses the upcoming crash with a New York Times reporter five months before the collapse of Lehman Brothers.

- According to Gurufocus, his Quantum Fund returned an annual return of 32% between 1969 and 2000.

The now 85-year-old Mr. Soros made a comeback to trading recently after some years on the sidelines. He is now buying gold and gold miners as he anticipates rough waters ahead. He is skeptical to both the Chinese and European economies and finds the US market to be overpriced. According to the Wall Street Journal, he is currently shorting the US market. I agree with Mr. Soros and find the US market to be bloated on most fundamental measures.

In October of 2009, Mr. Soros held a lecture at the Central European University where he discussed his market bubble theory. I recommend everyone to watch the lecture on YouTube.

Mr. Soros does not agree with the efficient market hypothesis fathered by Eugene Fama. As quoted by Mr. Fama:

"I take the market-efficiency hypothesis to be the simple statement that security prices fully reflect all available information""In an efficient market, at any point in time the actual price of a security will be a good estimate of intrinsic value"

Mr. Soros does not believe that financial markets are efficient and in equilibrium with the underlying fundamentals represented by "all available information." Instead, he believes that markets slide from the fundamentals over time. He believes markets go through stages where they slide farther and farther away from the underlying fundamentals through a positive feedback loop (numerous individual investors reinforcing each other's dissolutions over time).

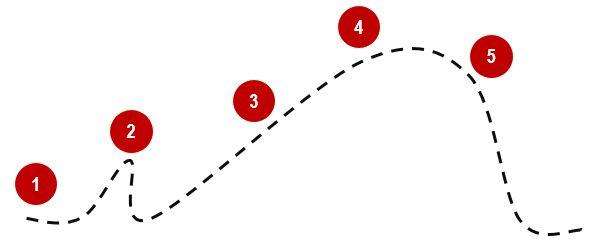

The stages of Mr. Soros bubble theory:

1. At first, the market slides slowly upwards over time in a rational manner before the positive feedback loop accelerates the market

2. The market goes through a test where it drops significantly. If the positive feedback loop is sufficiently strong, the market will overcome the test and continue its climb. At this point, the market will start to disconnect from underlying fundamentals in a big way.

3. The market will continue its climb farther and farther away from the fundamentals. For an equity index, this may be represented by an increase in pricing multiples not warranted by probable future earnings growth.

4. At some point in time, the market will reach a twilight zone where more and more investors become skeptical and bearish. The disconnect between asset prices and fundamentals recognized by some investors will slow down the market appreciation rate (probably where the S&P 500 (NYSEARCA:SPY) has been stuck the last couple of years).

5. At some point, for some reason, triggered by anything, the positive feedback loop will reverse and become a negative feedback loop. The negative feedback loop will quite swiftly develop into frantic panic.

Illustration of Mr. Soros bubble theory:

Source: Oeistein Helle, CFA

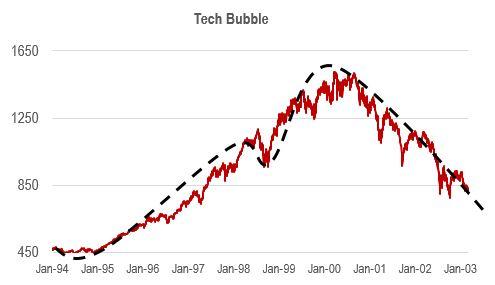

So how well does the above-illustrated theory perform in the real world? Let us fit the model on top of a graph of the S&P 500's pricing action during the full-cycle tech bubble of the nineties. It fits quite well does it not? During 1999, the market pushed through the test before it started flying. Close to the top of the cycle, the market appreciation slowed before the index turned.

Mr. Soros' bubble theory and the tech boom and bust cycle:

Source: Oeistein Helle, CFA

Let us test the theory for the more recent housing bubble that unraveled in 2008. For the 2002-2009 business cycle, the model fits. During 2003, the S&P 500 appreciated significantly before it was tested in 2004. The positive feedback loop driving the market was strong enough to break through the test and continued its climb. During 2007, the market reached the twilight zone before it tanked in 2008.

Mr. Soros' bubble theory and the housing boom and bust cycle:

Source: Oeistein Helle, CFA

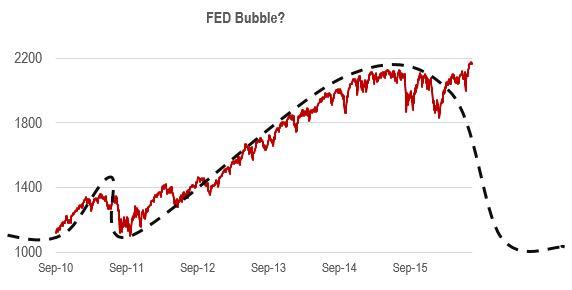

What about the current business cycle? Does the theory fit? Yes, it may do. The markets appreciated up until 2011 when the positive feedback loop was tested. When the market managed to break through the 2011 test, the feedback loop got stronger and kept on going. As observed, we may currently be in the twilight zone (thus, all the bearish articles written by smart analysts on Seeking Alpha). One of these days, we may reach the fifth and last stage of the model. The feedback loop will turn negative.

Mr. Soros' bubble theory and the Fed bubble? Boom and bust cycle:

Source: Oeistein Helle, CFA

As demonstrated by his previous market calls and according to Forbes ~USD 25 Billion fortune, George Soros is an investor worth paying attention to. The man himself is currently buying gold hand over fist, as he believes that we are closing in on a bear market. Mr. Soros' bubble theory may tell us that the day of reckoning is getting close for the S&P 500 as we currently may be stuck in the twilight zone. As illustrated above, the theory has explained the previous market boom and bust cycles quite well.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.