This article was first published on SeekingAlpha September 23. 2016:

Summary

Previously I have played with the notion of shorting Tesla or the S&P 500. I have concluded that such positions do not represent the sure thing.

If the world is going to hell in a handbasket you may as well short the center of the deterioration: Italian banks.

I will use this article to explain why you should short Italian banks and which banks you should short.

Previously I have played with the notion of shorting Tesla (TSLA) due to the stock's obvious overvaluation compared to its peers, bubble like qualities and high cash burn rate. You can read more about my take on Tesla in my blog. The problem with shorting Tesla is that it is not a sure thing as you may be betting against an electrification revolution. I have also fooled around with the idea of shorting the S&P 500 (SPY) due to its frothy valuation and record taking bull-run. The problem with shorting the S&P 500 is that you may end up fighting the FED, a mighty opponent. So what to short if you do not believe in being long a market that in my perception is doomed to crash at some point? The answer is obvious from a European standpoint: Italian banks (EWI). I will use this article to explain why you should short Italian banks and which banks you should short.

Why Italian banks are broken

- Post the 2008 crash Italian banks incurred a huge amount of bad debt, and a lot more than most European banks. From 2008 to 2015 so called none performing loans or NPLs increased by 85% reaching close to ~20% of total loans or ~EUR 360B for the Italian banking system as a whole. In contrast German banks NPLs stand at ~2.5%.

- The majority of NPLs stem from loans made to Italian businesses, which have struggled since Italy joined the Eurozone in 1999. Italy has experienced lackluster GDP growth for more than 15 years now. Furthermore, the Italian economy is not expected to experience a growth renaissance anytime soon. Italian 2015 real GDP growth was 0.76%, and is expected to stay at 1% yearly growth until 2020 according to Statista.

- Many Italian banks are in need of additional capital. Unfortunately, the European Union has implemented new regulations earlier this year making it impossible for the Italian government to bailout banks. Instead, so-called bail-ins have replaced the good old bailout, where bank bondholders and stockholders have to take a major blow before the state can support the banks with much needed capital. Bail-ins is not an alternative politically as a lot of retail investors have invested in unsecured bank bonds. The only real option for technically bankrupt Italian banks to raise needed capital is through seasoned equity offerings alongside the sale of bad loans. An operation that will guarantee a lot of pain for the current shareholders.

- Subzero interest rates works like poison on banks' earnings power. The current European interest rate environment is hurting the fragile Italian banks.

- Communists and fascists. Communists may overtake Italy alongside far right fascists. The number one priority for the Italian communists and fascists is to exit the European Union. Nationalization of banks is a priority for the communists. According to polls, the Italian communist party has support from ~30% of the people, while the fascist party has support from ~10%. There is an opportunity for these extreme political fractions to overtake control of the government soon as Italy will hold a referendum on a constitutional reform in November or December of this year. The Italian prime minister has stated that he will resign if he loses the referendum, creating an opportunity for the communists and fascists to overtake political control of Italy.

How to assess which banks to short

The NPLs on the banks balance sheets need to be dealt with in order for the banks not to run out of liquidity. When 20% of a bank's loans are not repaid, it is obvious that the bank at some point will run out of cash as banks usually are 90% leveraged and are dependent on getting their money back from their debtors.

Montepaschi, which is the Italian bank with the greatest percentage of bad loans on their balance sheet among major Italian banks declared in July a plan for restructuring which included increased coverage to 67% and 40% for bad loans and problem loans respectively. Included in the plan is the securitization and deconsolidation of all bad loans and an equity capital issue to offset the losses derived from the measures.

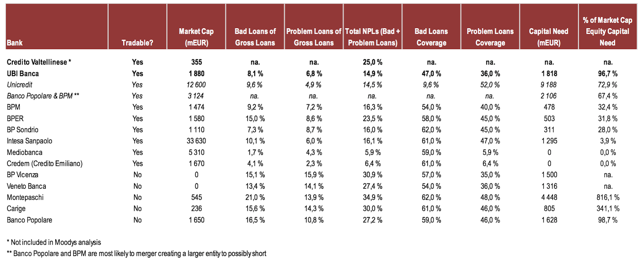

Moodys has written a study where they estimate the capital need for each of the 14 largest banks in Italy. The capital need is estimated under the assumption that the other Italian banks will restructure under the same scheme as Montepaschi. The resulting capital need is based on the individual bank's percentage of bad loans and problem loans and current problem loans coverage. As such restructuring schemes will force the restructuring banks to issue new equity capital. I find it reasonable to believe that the best banks to short is the ones, which have the greatest amount of capital need in percentage of their current market cap.

Which banks to short

As seen from the below table there are several banks that I am not able to short due to restrictions set by my broker. I guess my broker cannot find counterparts for short positions. Among the tradable (shortable if that was a word) banks with the greatest capital need in percentage of its current market cap, you find UBI Banca, Unicredit and a combined Banco Popolare (OTC:BPSAD) and BPM constellation (the two banks are merging). I expect that these banks will be forced to raise additional equity capital at some point soon, deteriorating shareholder value for the current shareholders in a significant manner. What has happened with Norwegian offshore companies such as Prosafe (OTCPK:PRSEY) and DoF this spring, will have to happen to Italian banks in significant need of capital later this year or next year.

I am currently short UBI Banca and Credito Valtellinese, and I am considering adding short positions in Unicredit and Banco Popolare/ BPM. Credito Valtellinese was not included in the Moodys study, however you can read more about the current state of the bank here.

Equity capital need and NPL overview, Italian banks

Conclusion

A handful of Italian banks are currently in a dire strait due to a high percentage of NPLs Vs. gross loans, anemic economic growth and subzero European interest rates. These banks need to restructure and recapitalize, creating a no brainer short opportunity for the brave investor. Please keep in mind that stocks of collapsing companies such as the above mentioned Italian banks tend to be super volatile. This is not a bet for the faint hearted.

Some of my readers may believe that entering short positions in Italian banks now is too late, as the story has been unfolding for more than a year now. I believe that a selection of Italian banks still represent a fantastic shorting opportunity, as they have not yet made actionable moves needed to solve the NPL issue.

Somewhat related to this article: In my day-to-day I own and run a small intermediary firm executing institutional Private Equity and Alternative Investment deals (Intrinsic AI AS). On a weekly basis we meet with institutional investors who want to deploy capital into risky assets, even begging us to come up with deals for them to buy. The same institutional representatives who are begging us for deals, all tell me over a cup of coffee that the world is going to hell in a handbasket. I have not met one single institutional investor representative this month who is not 100% cash with their own money, still they are eager to take risk with their clients money. Something really weird is going on.

Disclosure: I am/we are short UBI BANCA AND CREDITO VALTELLINESE.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Editor's Note: This article covers one or more stocks trading at less than $1 per share and/or with less than a $100 million market cap. Please be aware of the risks associated with these stocks.